In the fast-paced world of tech, the revolving door of developer talent has become a prevalent challenge for companies aiming to build robust in-house teams. With the median time developers spend at a company just over one year, it’s time to rethink traditional hiring strategies. In this blog, we explore the drawbacks of sticking to the status quo and advocate for a game-changing approach: hiring an extended team to leapfrog competition, accelerate product development, and minimize opportunity costs.

Embracing Change:

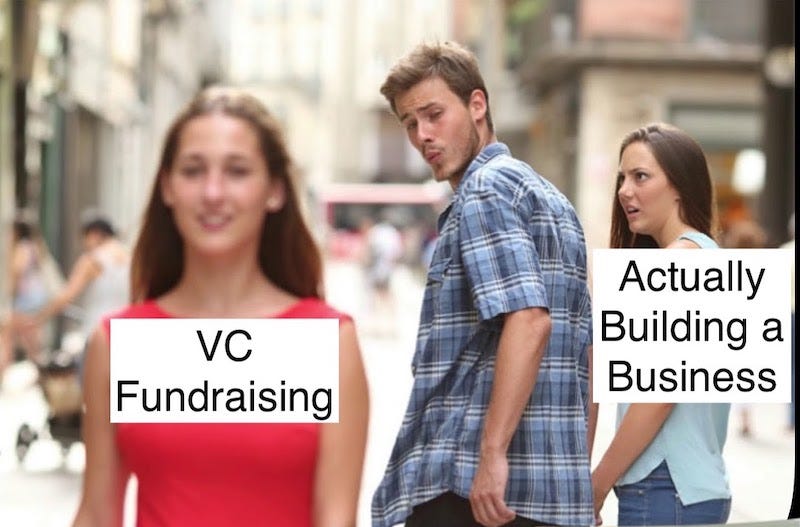

The traditional model of investing time and resources in building an in-house tech team, only to witness high turnover rates, is a costly affair. Instead of running marathons while still figuring out how to walk, businesses should consider a more agile and strategic approach. By embracing change and hiring an extended team, companies can navigate the challenges of talent retention and maximize their potential for success.

Opportunity Costs Unveiled:

Building an in-house team demands time, effort, and significant financial investment. However, the risk of losing millions in opportunity costs becomes apparent when developers, on average, switch jobs every year. Waiting for the perfect cultural fit can further delay progress and hinder growth. It’s time to prioritize results over cultural nuances and opt for a more pragmatic hiring approach.

The Extended Team Advantage:

Hiring an extended team offers a solution to the pitfalls of the one-year turnover trend. This model allows companies to tap into a global pool of skilled professionals without the need for a lengthy recruitment process. By collaborating with seasoned experts who have already demonstrated their commitment and expertise, businesses can fast-track product development, scale efficiently, and, most importantly, reduce the risk of losing valuable time and resources.

Leapfrogging the Competition:

In a landscape where speed is often the key to success, the extended team approach becomes a game-changer. Rather than investing months in assembling an in-house team, companies can leapfrog the competition by swiftly onboarding an extended team. This agile approach enables businesses to focus on what matters most — building and scaling their product — without succumbing to the pitfalls of prolonged hiring processes.

Conclusion:

In a world where change is the only constant, businesses must adapt their strategies to stay ahead. The one-year turnover trend among developers is a clear signal that the traditional in-house hiring model is no longer the most effective option. By embracing the extended team approach, companies can minimize opportunity costs, accelerate growth, and leapfrog the competition. It’s time to shift the paradigm and build a tech team that propels your business forward. Don’t run marathons when you can leapfrog to success!

PS. We can help. Let’s talk. Link to my calendar — https://calendly.com/sukantk/talk