The startup ecosystem is abuzz with innovation, energy, and a constant quest for funding. While passion and dedication are essential ingredients for success, financial resources play a crucial role in propelling a startup from its nascent stages to exponential growth. However, timing your fundraising efforts is critical to maximizing your chances of securing the right investment and achieving your entrepreneurial dreams.

The Counterintuitive Art of Raising Funds from a Position of Strength

The conventional wisdom surrounding fundraising often suggests that seeking capital is urgent, especially when the startup is in its initial phases. However, this approach may not always yield the best results. Raising funds when your startup is demonstrating traction and displaying a proven business model can be far more advantageous.

This counterintuitive strategy stems from the simple fact that investors are more likely to be attracted to a startup that has already established its viability and potential for growth. When your startup has a clear runway, a solid track record of generating revenue, and a unique value proposition, you are in a better position to negotiate favourable terms with potential investors.

Traction: The Investor’s Magnet

Traction, a measure of a startup’s growth and momentum, is a key factor investors consider when evaluating funding opportunities. They seek evidence that your startup is gaining traction in its target market, demonstrating user engagement, and making strides towards achieving its business objectives.

While the exact level of traction required to attract investors varies depending on the industry and stage of the startup, consistently demonstrating month-over-month growth is a strong indicator of success. This upward trajectory signals to investors that your startup has the potential to scale and generate significant returns.

Relationships: The Cornerstone of Fundraising Success

Building relationships with potential investors is an ongoing process that should not be relegated to the fundraising stage alone. Networking with industry experts, attending investor conferences, and actively engaging with the startup community can open doors to valuable connections.

Establishing a rapport with investors early on provides an opportunity to showcase your startup’s vision, team, and potential. It also allows investors to get a firsthand understanding of your leadership, expertise, and ability to execute your business plan. These connections can prove invaluable when the time comes to seek funding formally.

The Right Time is Now: Seizing the Moment

The ideal time to raise funds for your startup is when you have a combination of factors working in your favour:

- Adequate Runway: A healthy runway, the amount of time a startup can operate without additional funding, provides stability and allows for strategic decision-making.

- Demonstrated Traction: Consistent growth and user engagement validate your startup’s potential and attract investor interest.

- Strong Relationships: Cultivated connections with potential investors foster trust and understanding, increasing the likelihood of favourable terms.

When these elements converge, your startup is well-positioned to secure the right funding at the right time. Remember, raising funds is not just about securing financial resources; it’s about partnering with investors who believe in your vision and can provide valuable guidance and support as your startup embarks on its journey to success.

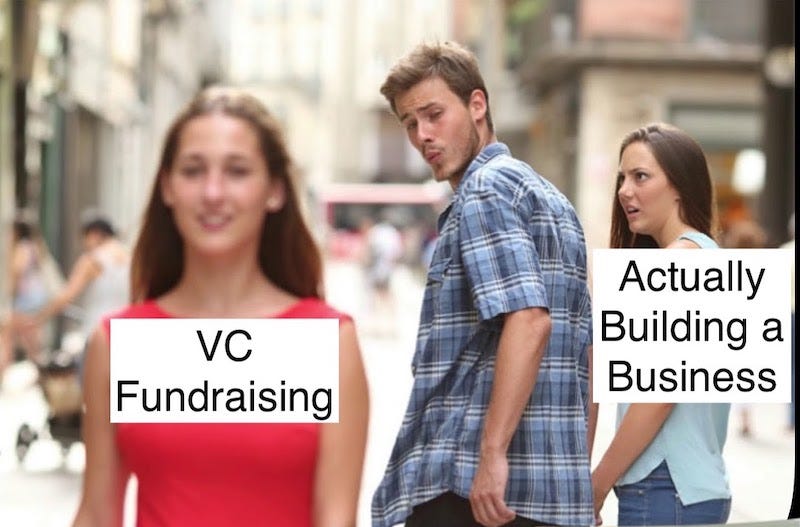

But, end of the day you should never prioritise fundraising more than building your product and business. Build a business that becomes a magnet for investors. Then you can raise money on your terms!

Are you raising money or looking at how can you leverage tech to do so?

Let’s talk? — https://calendly.com/sukantk/talk